capital gains tax canada exemption

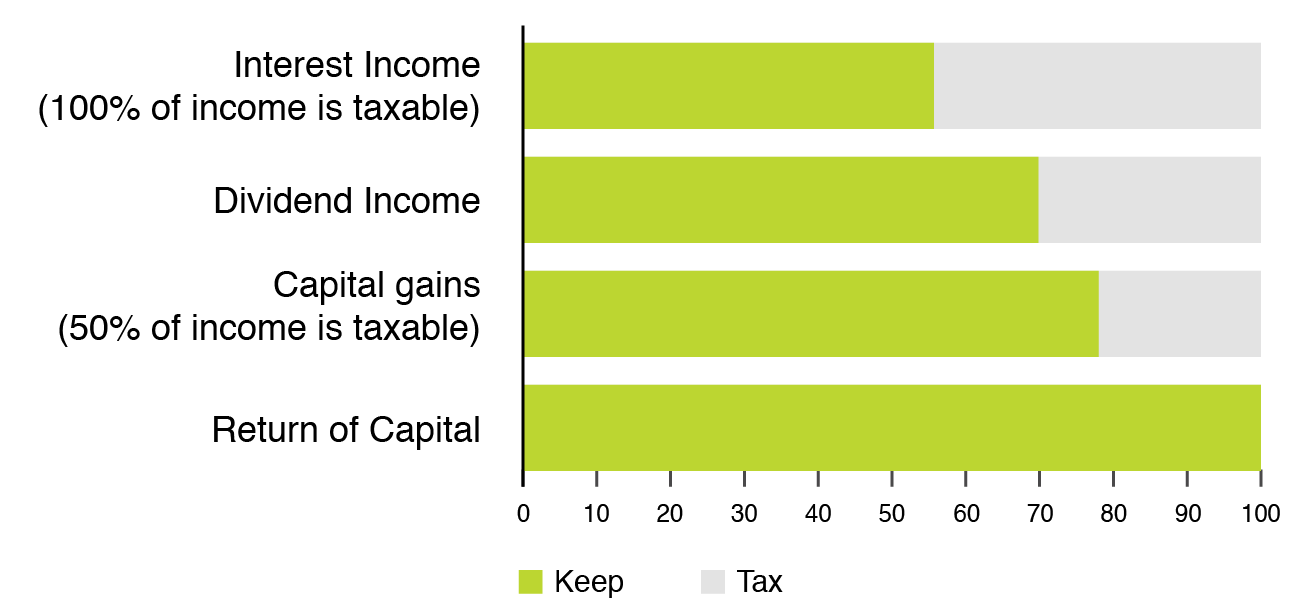

The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains.

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

The Capital Gains Exemption CGE remains one of the most beneficial components of the Canadian tax system.

. How much capital gains is tax free in Canada. In short it allows people to shelter a certain amount of capital gains. Your new cost basis as of Year 5 would be 850000.

The 1000000 capital gains exemption to be exact. In doing so it. The amount of the exemption is based on the gross capital gain that you make on the sale.

If you sold property in 2021 that was at any time your principal residence you must report the sale on Schedule 3 Capital Gains or Losses in 2021 and Form T2091 IND Designation of a. Rewarding resident Canadian business owners for. However there is a stipulation in.

However the Income Tax Act ITA allows. The lifetime capital gains exemptions LCGE is helpful for small business owners and their family members allowig them to avoid paying taxes on capital gains income up to a. The tax rate differs for property held for less than a year short-term capital gains tax which is taxed at a higher rate than the gain on the property held for more than a year.

Bullion and coins are liable to capital gains tax across Canada subject to personal-use property exemptions. And yes it is 1000000 - it was increased back in 2015. If your capital gains are 100000 you will be subject to a capital gains tax on 50000.

The lifetime capital gains exemption has helped many people save tax since it was introduced in 1986. The capital gains exemption. Under current law households can exempt from their capital gains taxes the first 250000 Single500000 Married of profits from the sale of a primary residence.

Residential Indians between 60 to 80 years of age will be exempted. Contrary to the popularly held belief that any capital gain or increase in value made on a primary residence is not taxable in Canada it is. Is there a one-time capital gains exemption in Canada.

The listed personal property rules state that coins with a resale value. However you would be. The capital gains tax rate in Ontario for the highest income bracket is 2676.

A taxpayer who sells his or her principle residence which is defined in the ITA becomes liable for paying tax on the capital gains. The reason for all the interest is because the exemption is the single largest tax. You can sell your primary residence and be exempt from capital gains taxes on the first 250000 if you are single and 500000 if married filing jointly.

This exemption is only. An individual will be exempted from paying any tax if their annual income is below a predetermined limit. However since only 50 percent of.

Https Www Financialexpress Com Money Income Tax Nris Need Not File Itr For Interest Income Below Taxable Limit 2050 Filing Taxes Income Tax Income Tax Return

Planning Considerations That Affect Your Lifetime Capital Gains Exemption Cwb Wealth Management

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Income Tax Filing Is It Compulsory To All Capital Gains Tax Estate Tax Money Market

Understand The Lifetime Capital Gains Exemption

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

Understanding The Lifetime Capital Gains Exemption And Its Benefits Davis Martindale Blog

How The Lifetime Capital Gains Exemption In Canada Works Lcge Youtube

Crystallizing The Lifetime Capital Gains Exemption A Toronto Tax Lawyer Analysis

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Lifetime Capital Gains Exemption Qualified Small Business Corporation Shares

Kalfa Law Capital Gains Exemption 2020 Capital Gains Tax

Benefits Of Incorporating Business Law Small Business Deductions Business